International real estate is increasingly becoming part of the digital infrastructure, not just a physical asset. Tech platforms have changed the very logic of ownership, rental, and investment decisions. Where local agencies once dominated, algorithms, marketplaces, and global digital services are now in place. This is not just convenience — it

Buying a home is one of the most significant decisions a person will make in their life. But contrary to popular belief, it’s not always based on cold calculation. Behavioural economics shows that cognitive biases – persistent errors in thinking – play a key role in how and why we choose a particular property. Understanding … Read More “Cognitive Biases in Home Buying: A Scientific Look at Irrational Investing” »

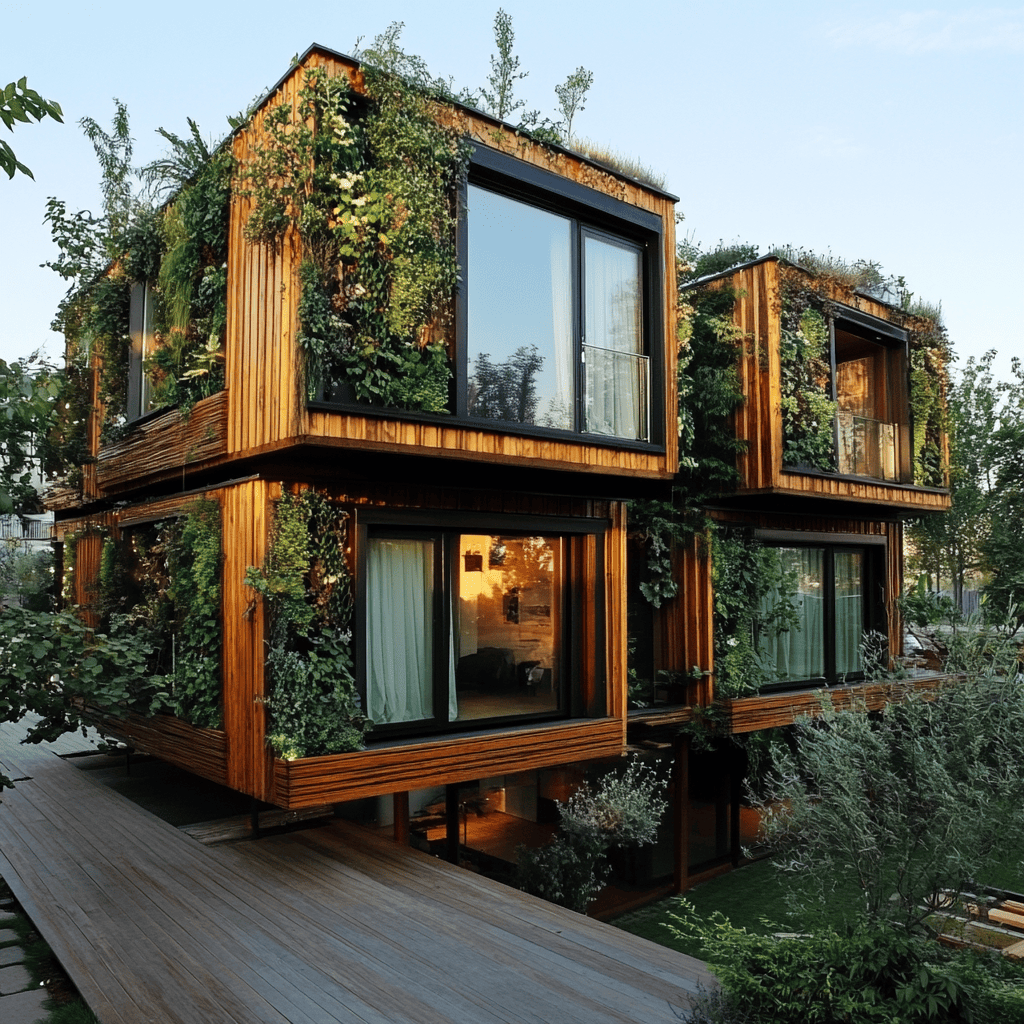

Eco-housing has long ceased to be the preserve of activists or the architectural elite – it is confidently entering the mainstream of the international real estate market. Increasing energy efficiency requirements, reducing carbon emissions and caring for the health of residents have become not just recommendations, but real standards for new projects in cities and … Read More “Eco-Housing: Fashion or Necessity? The Global Shift to Sustainable Homes” »

Tourism and short-term rentals are now more than just a service industry, but a powerful source of income in cities around the world. With the growth of online platforms and the convenience of digital services, investors are looking to invest in housing that brings in super-profits in tourist areas. However, behind the quick profits often … Read More “Tourism and short-term rentals: the geography of super profits and legal restrictions” »

The choice between renting and buying a home remains one of the key decisions in a person’s life, and in the context of globalization it has become even more difficult. Citizens are increasingly faced with the question: is it worth burdening yourself with property or is it more profitable to remain mobile and flexible? The … Read More “Renting versus buying: Theoretical foundations of rational choice across countries” »

At first glance, investing in housing and securities can bring comparable returns. However, millions of people around the world intuitively prefer real estate. Why is an object with a high entry cost, low liquidity and subject to physical depreciation perceived as a more reliable and desirable asset than shares or funds? The answer lies not … Read More “The Psychology of Ownership: Why People Invest in Homes, Not Stocks” »